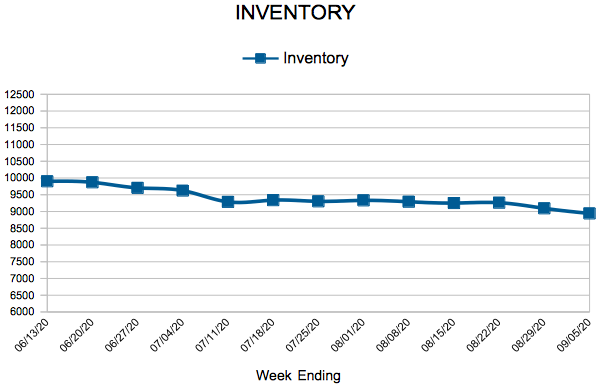

Inventory

Weekly Market Report

For Week Ending September 5, 2020

Strong buyer activity continues into the back-to-school season that normally signals the seasonal slowing of the housing market. With more buyers in the market and the continued constrained supply of homes for sale, speedy sales and multiple offers are likely to remain a common occurrence and will keep agents and prospective homebuyers and sellers quite busy this fall.

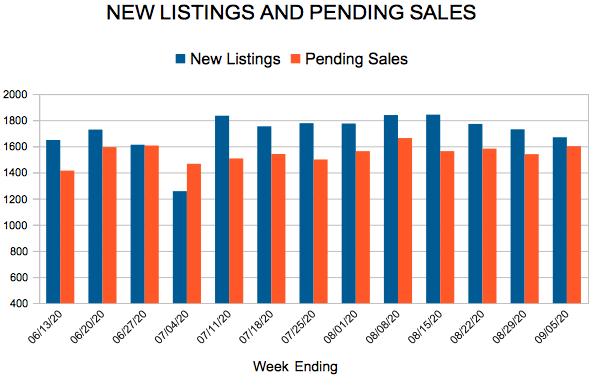

In the Twin Cities region, for the week ending September 5:

- New Listings decreased 3.4% to 1,669

- Pending Sales increased 40.3% to 1,601

- Inventory decreased 30.2% to 8,942

For the month of July:

- Median Sales Price increased 10.6% to $313,000

- Days on Market increased 7.9% to 41

- Percent of Original List Price Received increased 0.5% to 100.1%

- Months Supply of Homes For Sale decreased 23.1% to 2.0

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

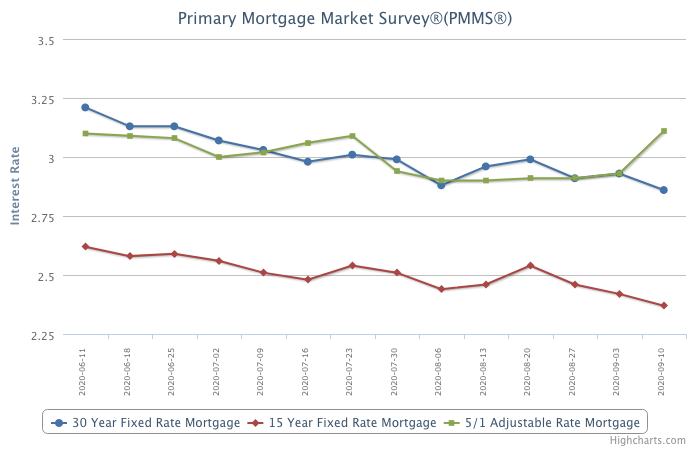

Mortgage Rates Hit Another All-Time Low

September 10, 2020

Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery. These low rates have ignited robust purchase demand activity, which is up twenty-five percent from a year ago and has been growing at double digit rates for four consecutive months. However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.

Information provided by Freddie Mac.

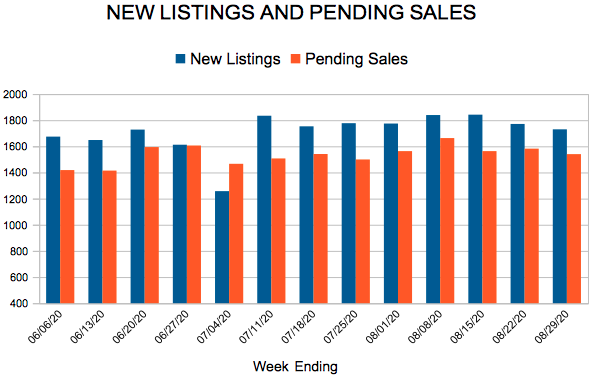

New Listings and Pending Sales

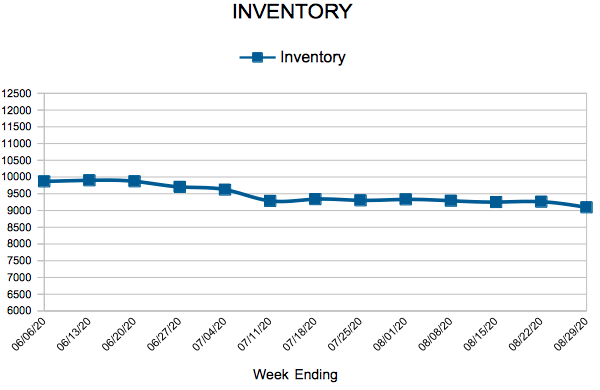

Inventory

Weekly Market Report

For Week Ending August 29, 2020

Mortgage rates continue to remain near all-time lows. This week, mortgage giant Freddie Mac reported that average rates on a 30-year fixed-rate mortgage were 2.91% with an average of .8 points, just slightly above the record-low rate of 2.88% recorded earlier in the month. The Federal Reserve has announced that they will be adopting a more flexible monetary policy in an effort to achieve inflation that averages 2% over time, which is likely to keep mortgage rates low and provide further support to economic activity for an extended period of time.

In the Twin Cities region, for the week ending August 29:

- New Listings increased 24.2% to 1,730

- Pending Sales increased 18.0% to 1,540

- Inventory decreased 30.7% to 9,094

For the month of July:

- Median Sales Price increased 10.6% to $313,000

- Days on Market increased 7.9% to 41

- Percent of Original List Price Received increased 0.5% to 100.1%

- Months Supply of Homes For Sale decreased 29.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

September Monthly Skinny Video

“Nationally, buyer and seller activity remained strong, buoyed by low mortgage rates.”

Weekly Market Report

For Week Ending October 12, 2019

For Week Ending October 12, 2019

In the last month, mortgage rates have fallen to their lowest monthly average in more than three years, and now Fannie Mae is predicting that continued low rates, and possibly lower rates, are expected in 2020. These historically low mortgage rates have and will continue to support buyer demand and may create additional lift to home prices as lower financing costs give buyers the ability to offer more to secure their dream home.

In the Twin Cities region, for the week ending October 12:

- New Listings increased 7.3% to 1,496

- Pending Sales decreased 5.9% to 1,036

- Inventory decreased 4.4% to 12,457

For the month of September:

- Median Sales Price increased 6.5% to $279,000

- Days on Market increased 2.4% to 43

- Percent of Original List Price Received increased 0.1% to 98.5%

- Months Supply of Homes For Sale decreased 3.7% to 2.6

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

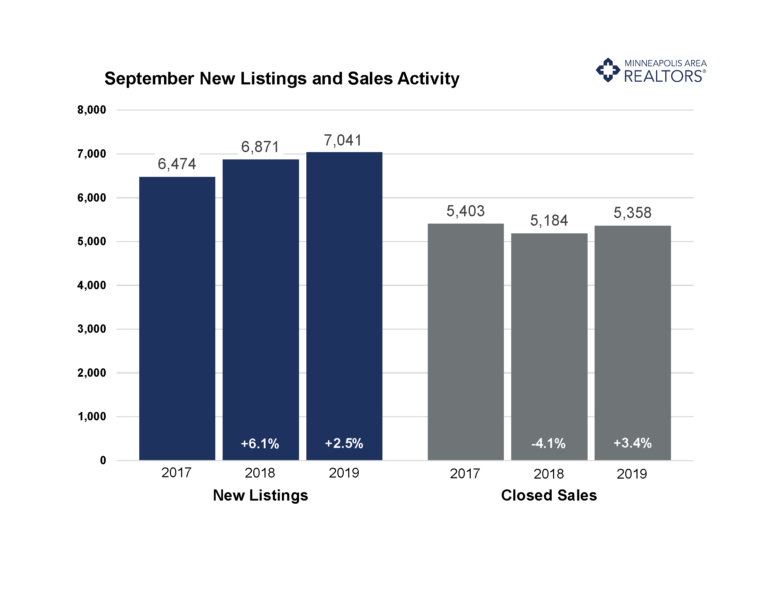

Sales, prices still rising despite some changes this year

The latest numbers for Twin Cities residential real estate show a stable market with some ongoing signs of transition. Prices are still rising, supply is still tight, and demand has recovered even while market times have lengthened. Even though more buyers are closing on homes, the urgency has subsided somewhat. Days on market rose 2.4 percent from last September, marking the fifth year-over-year increase in the last seven months. Market times remain swift despite modest increases. Sales rose 3.4 percent and the median sales price increased 6.6 percent to $279,250. Pending sales—a measure of signed contracts and future demand—rose 2.9 percent. Both pending and closed sales are down slightly for the year so far, but that may change. New listings were up 2.5 percent, helping some buyers take advantage of historically low rates. Sellers have been accepting a slightly lower share of their list price compared to the year prior for seven of the last eight months—with September bucking that trend. This, along with other indicators, suggests the market is rebalancing in a way that could benefit buyers.

The number of active listings for sale is up over the last 12 months and for most of 2019. Even so, the market remains tight—particularly for first-time buyers and downsizers competing in the under $300,000 segment where multiple offers and homes selling for over list price remain commonplace. Despite the demand, builders struggle to replenish inventory in that undersupplied segment due to high land and material costs combined with a significant labor shortage and tricky regulations. The shortage of affordable homes has led to an increase in remodeling as people are staying in their homes longer. It’s challenging to find comparable home at a similar payment in the desired location. With just 2.5 months of supply, the Twin Cities is still significantly undersupplied.

September 2019 by the Numbers (compared to a year ago)

- Sellers listed 7,041 properties on the market, a 2.5 percent increase from last September

- Buyers closed on 5,358 homes, a 3.4 percent increase

- Inventory levels decreased 5.6 percent from last September to 12,478 units

- Months Supply of Inventory was down 7.4 percent to 5 months

- The Median Sales Price rose 6.6 percent to $279,250

- Cumulative Days on Market rose 2.4 percent to 43 days, on average (median of 22)

- Changes in Sales activity varied by market segment

-

- Single family sales rose 5.5 percent; condo sales increased 1.4 percent; townhome sales fell 0.5 percent

- Traditional sales increased 4.8 percent; foreclosure sales dropped 21.1 percent; short sales fell 55.6 percent

- Previously owned sales were up 4.4 percent; new construction sales climbed 2.6 percent

Quotables

“Attractive interest rates have unleashed some of the pent-up demand from earlier this year,” said Todd Urbanski, President of Minneapolis Area REALTORS®. “But each price point, product type and area is unique.”

“Buyers are still very much motivated despite some challenges,” said Linda Rogers, President-Elect of Minneapolis Area REALTORS®. “It really shows the resilience of our region and the value of homeownership.”

From The Skinny Blog.