For Week Ending July 16, 2022

For Week Ending July 16, 2022

Increasing homeownership costs have led many prospective homebuyers to continue renting, adding additional pressure to an already highly competitive rental market. Rental vacancy rates have remained below 6% since Q3 2021, a 3-decade low, the U.S. Census Bureau reports. As demand continues to outpace supply, rents on new leases have surged 14.1% this year through June, according to Apartment List, a huge leap from the typical 2% – 3% annual rent increases before the pandemic.

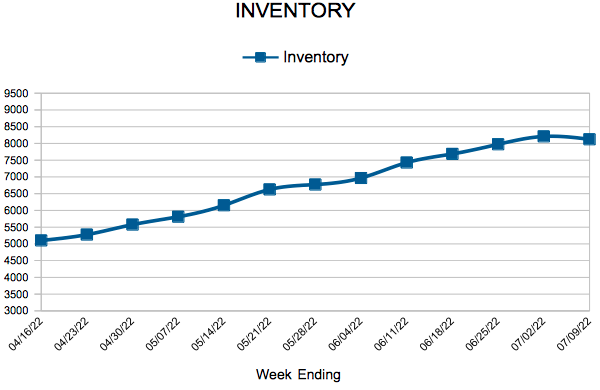

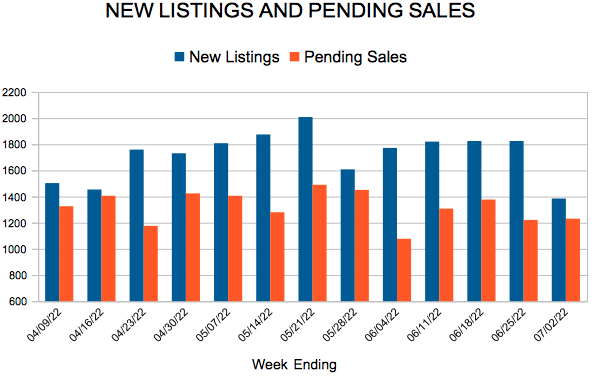

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 16:

- New Listings decreased 11.5% to 1,750

- Pending Sales decreased 24.8% to 1,097

- Inventory increased 10.1% to 8,441

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.