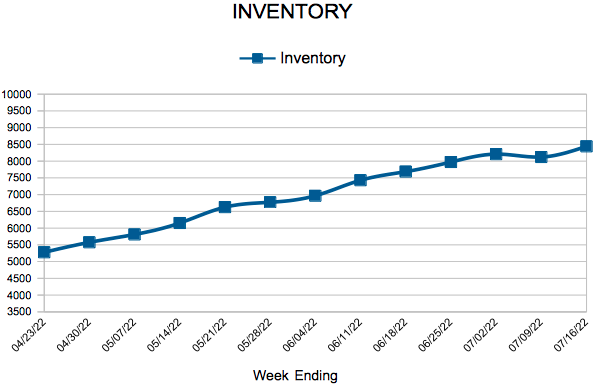

Inventory

Weekly Market Report

For Week Ending July 30, 2022

For Week Ending July 30, 2022

As housing supply continues to increase across the country, prospective buyers’ housing expectations are on the rise as well, with the National Association of Home Builders (NAHB) reporting the share of prospective buyers expecting their home search to be easier in the coming months climbed to 22% in the second quarter, up from 17% in the first quarter. The NAHB attributes the improved outlook among buyers to increases in inventory and a decline in buyer competition.

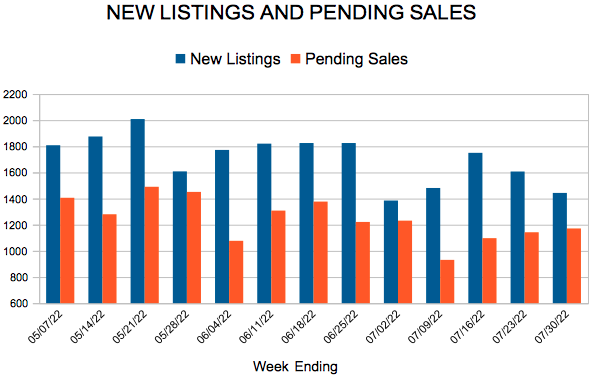

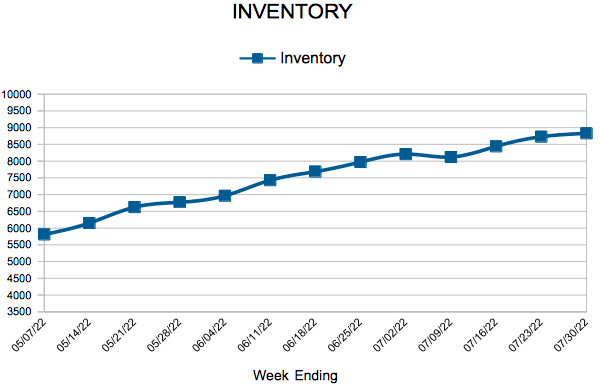

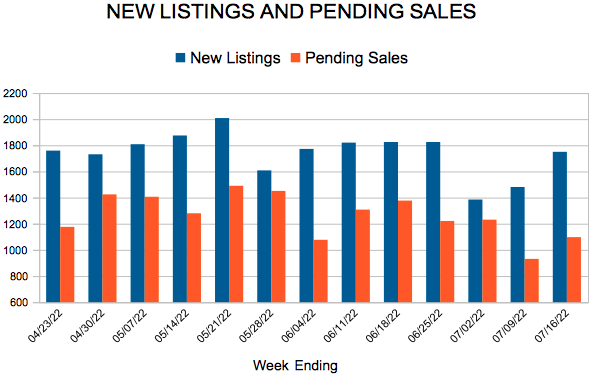

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 30:

- New Listings decreased 24.5% to 1,443

- Pending Sales decreased 22.4% to 1,171

- Inventory increased 10.3% to 8,830

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

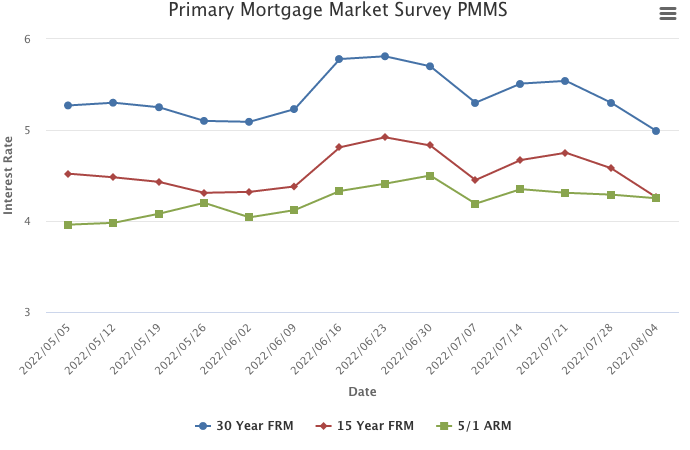

Mortgage Rates Drop Below Five Percent

August 4, 2022

Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 23, 2022

For Week Ending July 23, 2022

Mortgage applications declined for the fourth straight week, falling 1.8 percent from the previous week and marking the lowest level of activity since February 2000, according to the Mortgage Bankers Association. Increasing mortgage rates, escalating sales prices, and decades-high inflation continue to hinder affordability, putting homeownership on hold for many prospective buyers.

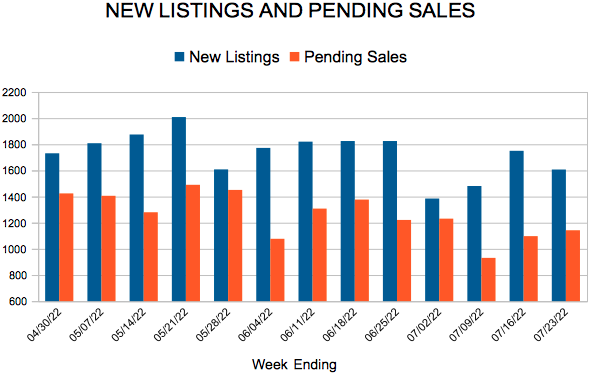

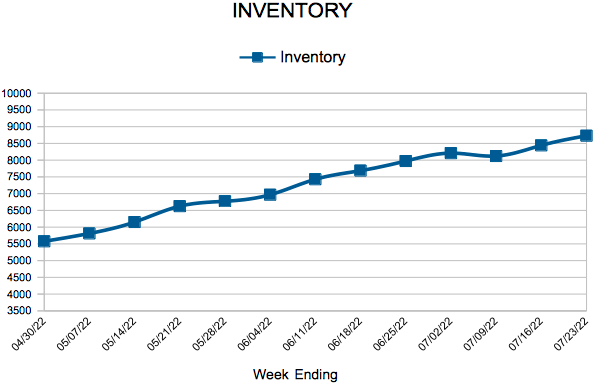

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 23:

- New Listings decreased 13.5% to 1,607

- Pending Sales decreased 25.1% to 1,142

- Inventory increased 9.7% to 8,729

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Fluctuate

July 28, 2022

Purchase demand continues to tumble as the cumulative impact of higher rates, elevated home prices, increased recession risk, and declining consumer confidence take a toll on homebuyers. It’s clear that over the past two years, the combination of the pandemic, record low mortgage rates, and the opportunity to work remotely spurred greater demand. Now, as the market adjusts to a higher rate environment, we are seeing a period of deflated sales activity until the market normalizes.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 86

- 87

- 88

- 89

- 90

- …

- 128

- Next Page »