For Week Ending August 13, 2022

For Week Ending August 13, 2022

After declining for three consecutive quarters, the share of homebuyers actively searching for a home grew to 49% nationally in the second quarter of 2022, up from 46% the previous quarter, according to the National Association of Home Builders (NAHB) recent Housing Trends Report. NAHB economists credit the rise in buyer activity to a less competitive housing market, which has motivated more prospective buyers to advance from the planning stage of the homebuying process to actively trying to purchase a home.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 13:

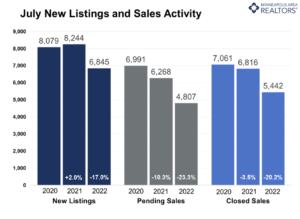

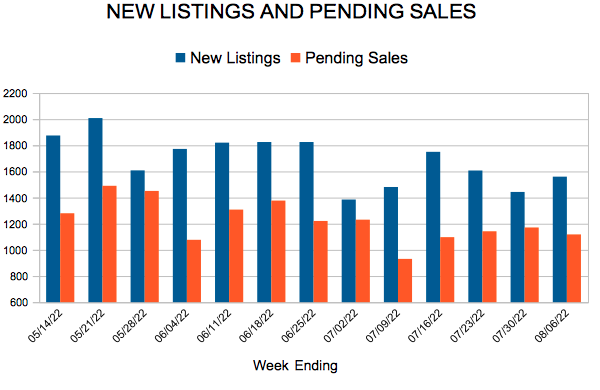

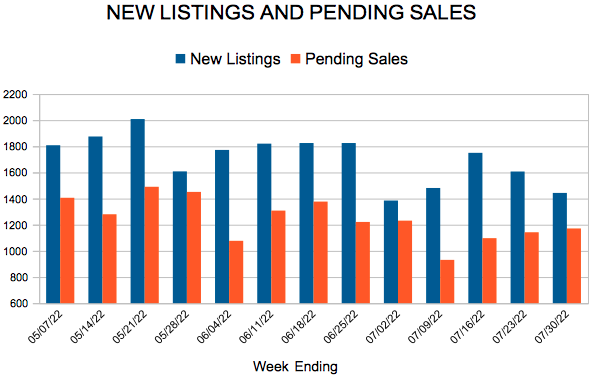

- New Listings decreased 16.0% to 1,480

- Pending Sales decreased 22.6% to 1,173

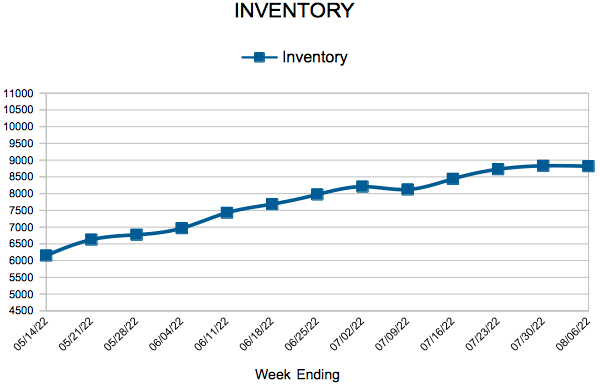

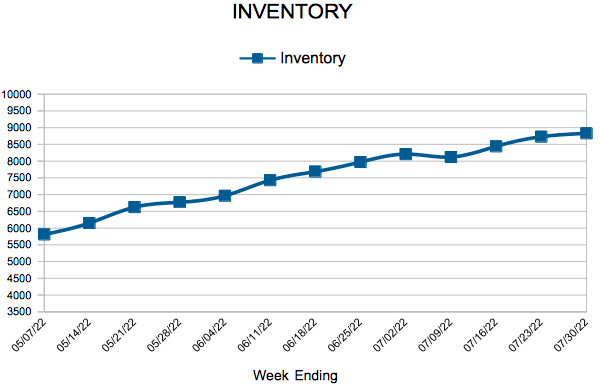

- Inventory increased 5.4% to 8,948

FOR THE MONTH OF JULY:

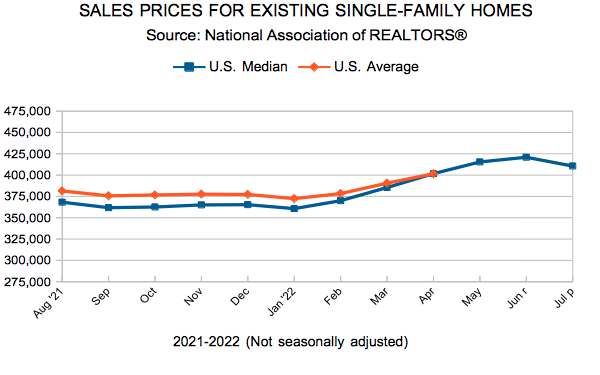

- Median Sales Price increased 7.1% to $375,000

- Days on Market increased 15.8% to 22

- Percent of Original List Price Received decreased 2.0% to 101.5%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.