Weekly Market Report

For Week Ending December 24, 2022

For Week Ending December 24, 2022

Elevated mortgage rates continue to take a toll on the construction industry, with housing permits for new homes falling 11.2% in November, according to the Commerce Department. Housing starts were down 0.5% over the same time period, with the annual rate of housing starts down 16.4% from the previous year. Overall construction was strongest in the West and the South, while single-family construction was strongest in the West and Northeast.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 24:

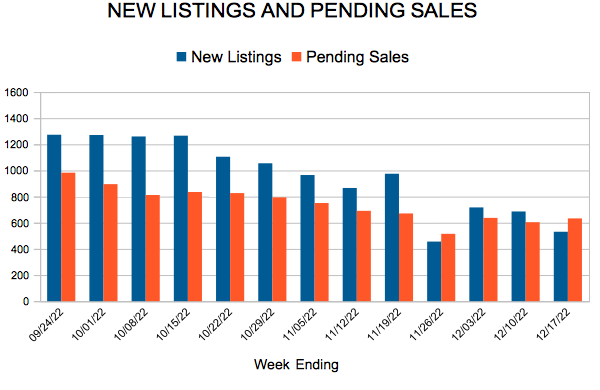

- New Listings decreased 5.6% to 303

- Pending Sales decreased 20.8% to 449

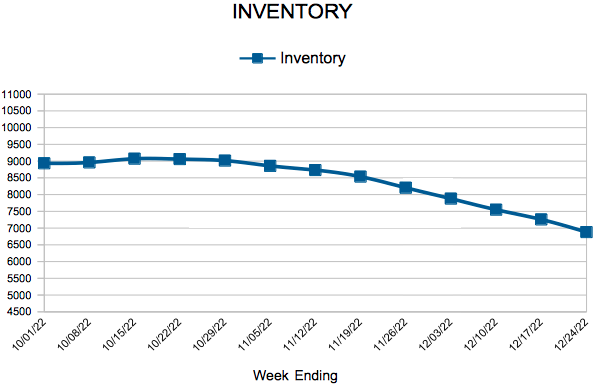

- Inventory increased 18.8% to 6,881

FOR THE MONTH OF NOVEMBER:

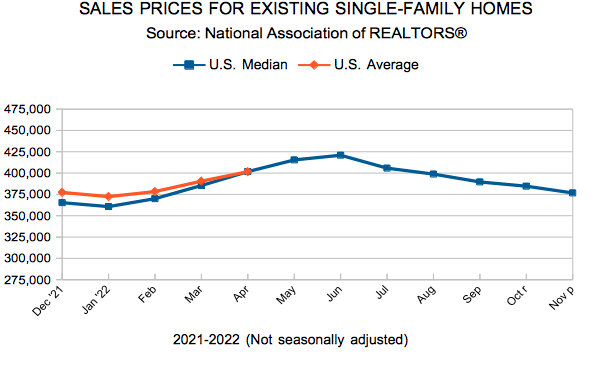

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

November Monthly Skinny Video

October Monthly Skinny Video

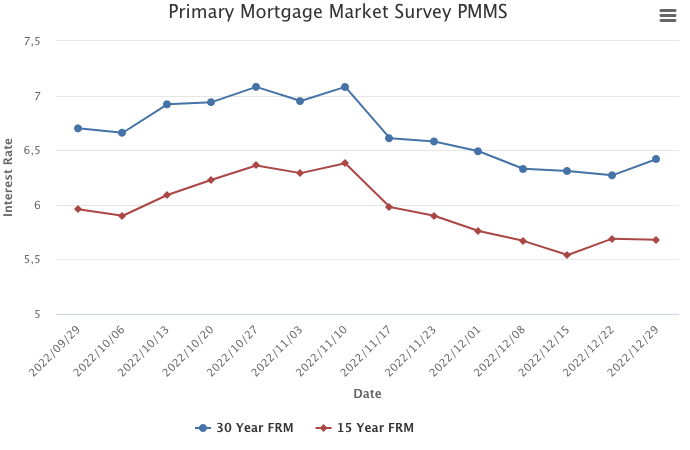

The 30-Year Fixed-Rate Moves Higher

December 29, 2022

The housing market remains in the doldrums with declining sales, inventory and prices. The declines in sales and deceleration in home prices began swiftly earlier in 2022 but have moderated more recently. While the intensity of weakness is moderating, the market continues to decline and forward leading indicators suggest housing will remain weak throughout the winter.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 17, 2022

For Week Ending December 17, 2022

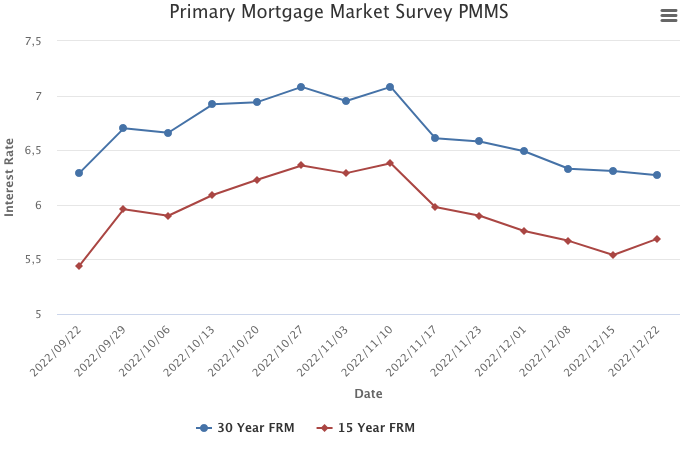

Mortgage rates continued their downward trend of recent weeks, as the 30-year fixed-rate mortgage averaged 6.31% the week ending 12/15, according to Freddie Mac. Mortgage rates have fallen for the past 5 weeks, declining by more than three-quarters of a percent in that time, and are at their lowest level since September. The drop in rates has resulted in an uptick in mortgage refinance demand, which increased 6% from the previous week, according to the Mortgage Bankers Association.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 17:

- New Listings decreased 11.1% to 531

- Pending Sales decreased 23.2% to 633

- Inventory increased 17.1% to 7,258

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

The 30-Year Fixed-Rate Mortgage Continues to Trend Down

December 22, 2022

Heading into the holidays, mortgage rates continued to move down. Rates have declined significantly over the past six weeks, which is helpful for potential homebuyers, but new data indicates homeowners are hesitant to list their homes. Many of those homeowners are carefully weighing their options as more than two-thirds of current homeowners have a fixed mortgage rate of below four percent.

Information provided by Freddie Mac.

Existing Home Sales

- « Previous Page

- 1

- …

- 73

- 74

- 75

- 76

- 77

- …

- 124

- Next Page »