March 3, 2022

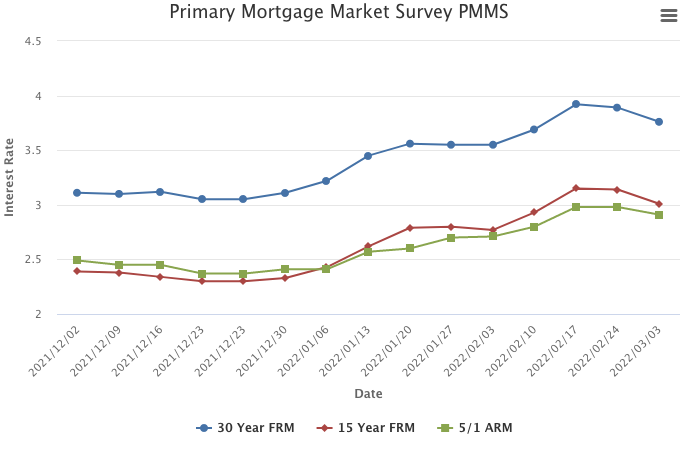

Geopolitical tensions caused U.S. Treasury yields to recede this week as investors moved to the safety of bonds, leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.

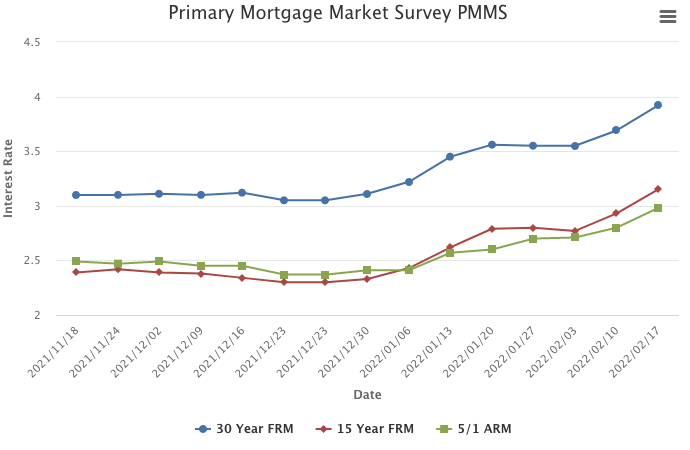

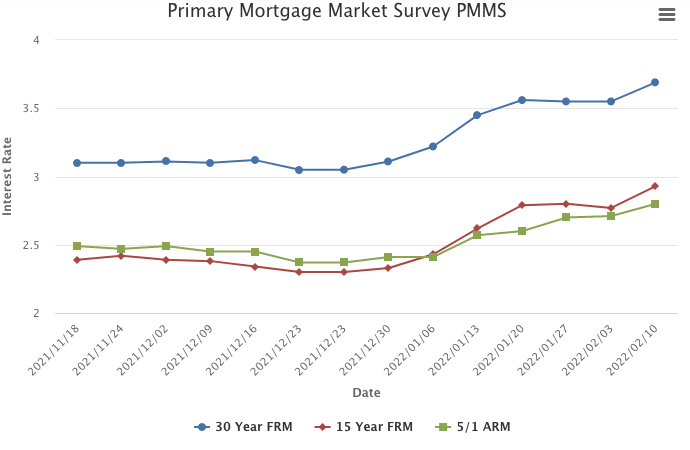

Information provided by Freddie Mac.