Weekly Market Report

For Week Ending October 12, 2024

For Week Ending October 12, 2024

According to the Mortgage Bankers Association, the median mortgage application payment was $2,057 in August, down from $2,140 in July, marking the fourth consecutive month affordability conditions improved. Mortgage rates are down significantly from their peak of 7.79% last October, which should help bring additional buyers to the market in the months ahead.

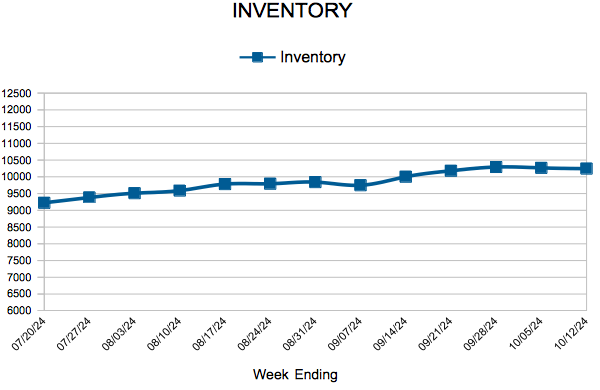

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 12:

- New Listings increased 12.5% to 1,368

- Pending Sales increased 7.3% to 865

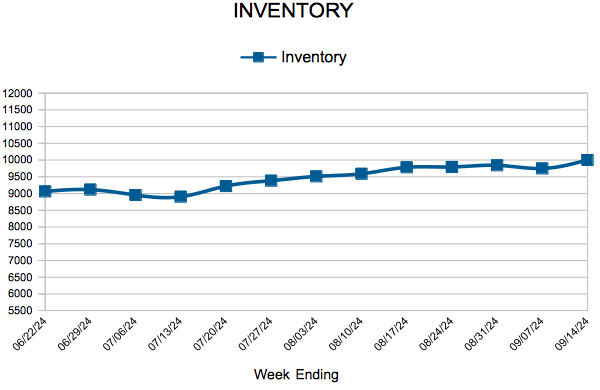

- Inventory increased 10.8% to 10,244

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $379,950

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 5, 2024

For Week Ending October 5, 2024

According to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers, buyers moved a median distance of 20 miles to their new home last year, down from 50 miles the year before, and closer to the previous norm of 15 miles. Among those buyers surveyed, 60% said the quality of the neighborhood was the most important factor in deciding where to move, while proximity to friends and family and housing affordability came in at 45% and 39%, respectively.

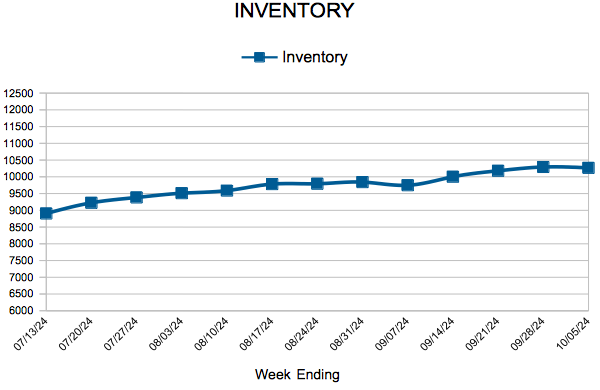

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 5:

- New Listings increased 14.9% to 1,447

- Pending Sales increased 19.5% to 1,007

- Inventory increased 12.0% to 10,267

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 28, 2024

For Week Ending September 28, 2024

The average rate on a 30-year fixed mortgage dropped to 6.08% the week ending September 26, 2024, the lowest level in two years, according to Freddie Mac. Rates have fallen one and a half percentage points over the past 12 months, and buying power has increased significantly as a result, with Realtor.com reporting the typical homebuyer could afford a home priced $74,000 higher than the October 2023 median sales price for the same monthly payment.

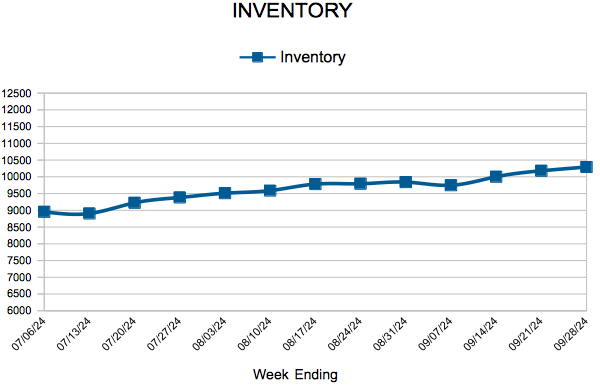

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 28:

- New Listings increased 11.5% to 1,337

- Pending Sales increased 4.4% to 935

- Inventory increased 12.3% to 10,293

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 21, 2024

For Week Ending September 21, 2024

Nationally, inventory was up 35.8% year-over-year in August, according to Realtor.com’s latest Monthly Housing Market Trends Report, with active listings now at the highest level since May 2020. As the number of homes for sale continues to grow in many areas, some agents are reporting that list prices are softening, homes are spending more time on market, and price reductions are becoming more common compared to the same period last year.

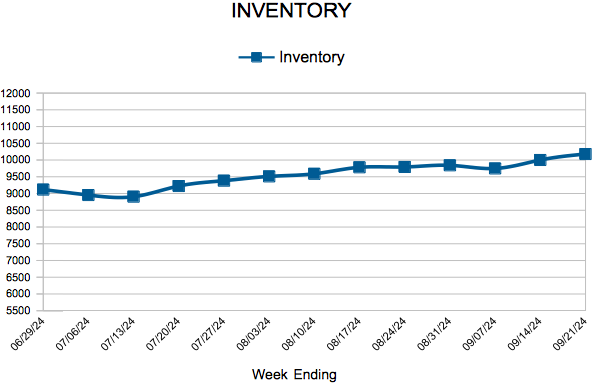

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 21:

- New Listings increased 11.9% to 1,435

- Pending Sales decreased 1.5% to 879

- Inventory increased 11.4% to 10,180

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.1% to $388,000

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 14, 2024

For Week Ending September 14, 2024

Mortgage activity surged the week ending September 13, 2024, as falling interest rates boost borrower demand nationwide. The Mortgage Bankers Association reports mortgage loan application volume increased 14.2% on a seasonally adjusted basis from the previous week, with purchase applications up 5%, while refinance applications jumped 24% from one week earlier.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 14:

- New Listings decreased 0.6% to 1,433

- Pending Sales decreased 5.1% to 856

- Inventory increased 11.4% to 10,002

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 46

- Next Page »