For Week Ending September 26, 2020

The Mortgage Bankers Association reported that the share of mortgages currently in forbearance dropped to 6.93% as of September 13, 2020, the 15th weekly decline in a row and its lowest level in five months. The share of mortgages in forbearance peaked in June at 8.55%. The continued decline is a positive sign, but current levels suggest many homeowners are still struggling from unemployment or underemployment due to the pandemic.

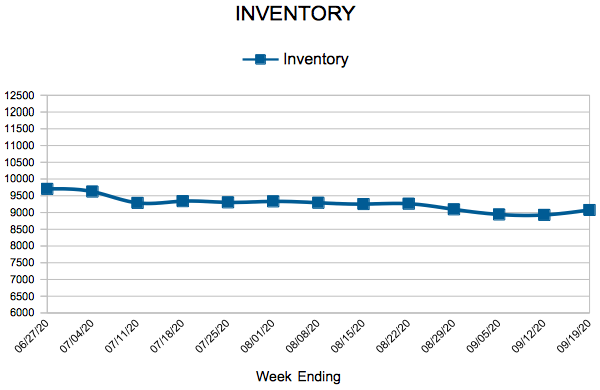

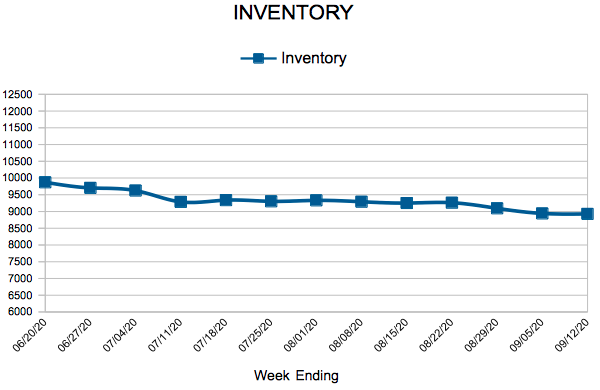

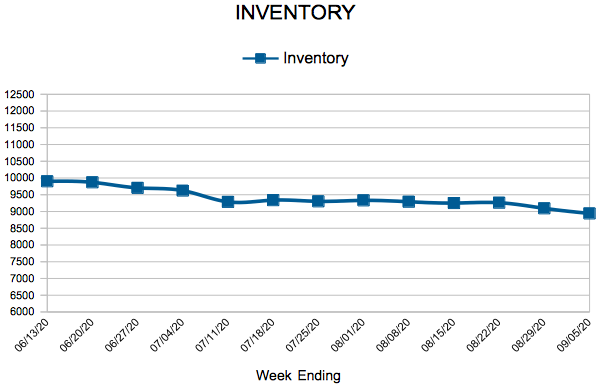

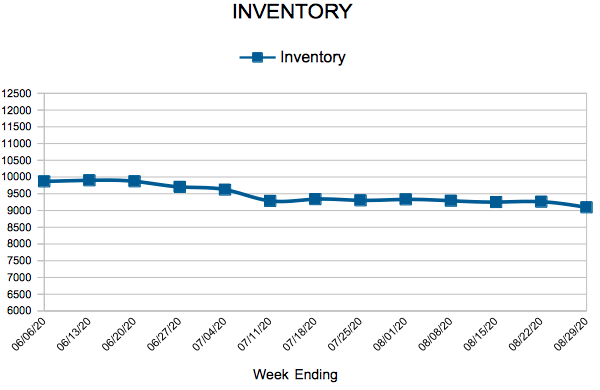

In the Twin Cities region, for the week ending September 26:

- New Listings increased 11.2% to 1,747

- Pending Sales increased 27.7% to 1,449

- Inventory decreased 31.1% to 9,154

For the month of August:

- Median Sales Price increased 9.8% to $315,000

- Days on Market decreased 4.9% to 39

- Percent of Original List Price Received increased 1.3% to 100.3%

- Months Supply of Homes For Sale decreased 30.8% to 1.8

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.