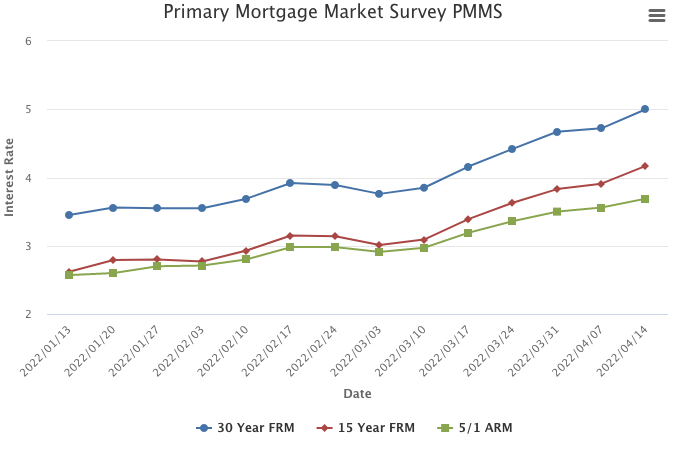

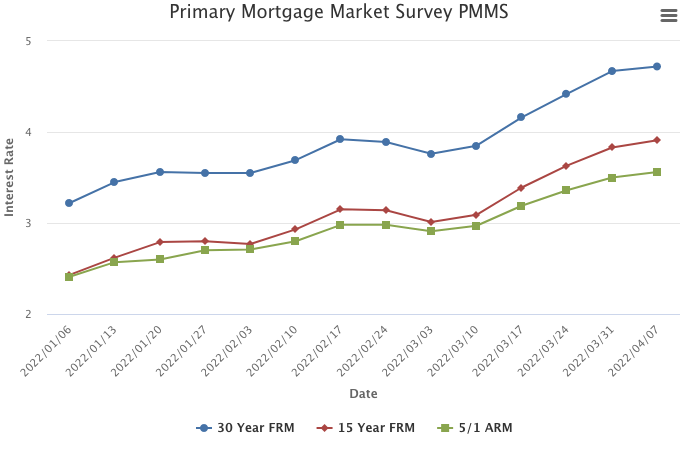

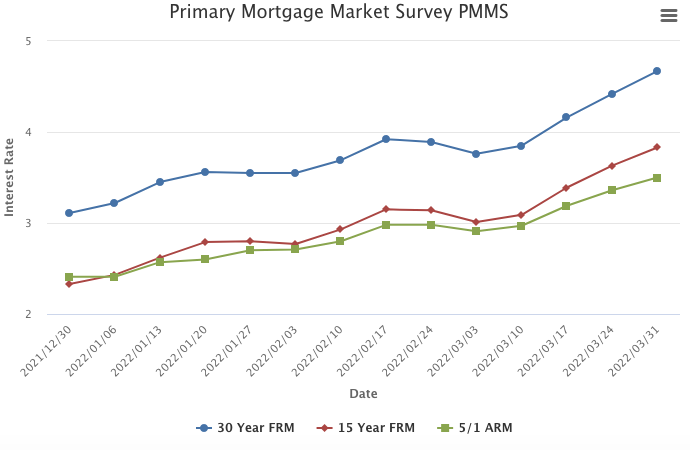

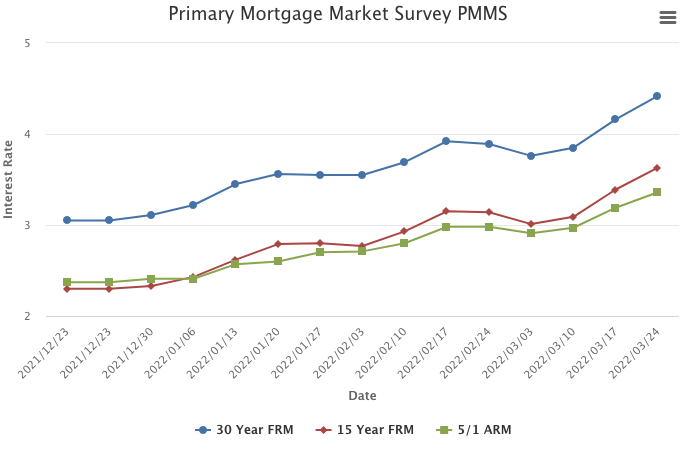

April 21, 2022

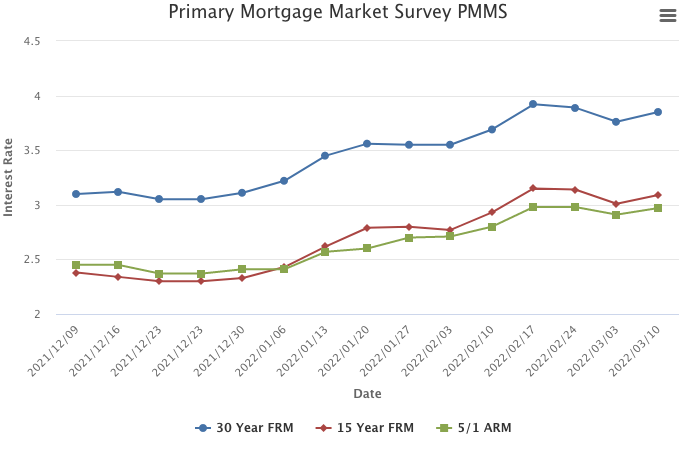

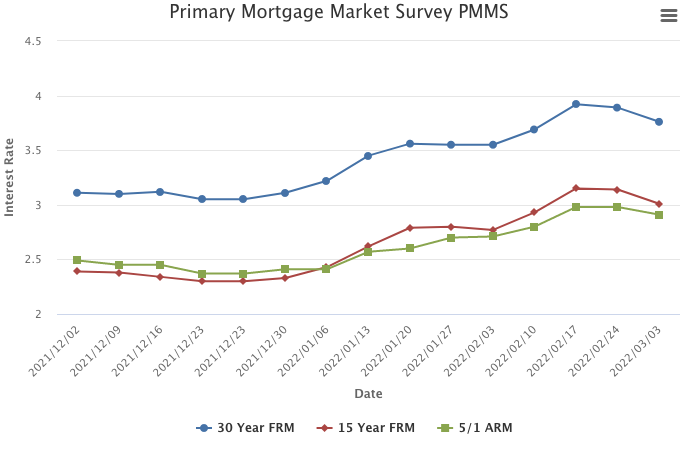

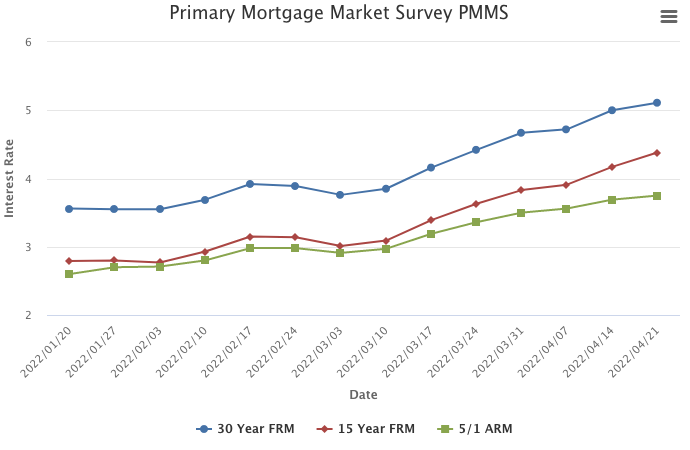

Mortgage rates increased for the seventh consecutive week, as Treasury yields continued to rise. While springtime is typically the busiest homebuying season, the upswing in rates has caused some volatility in demand. It continues to be a seller’s market, but buyers who remain interested in purchasing a home may find that competition has moderately softened.

Information provided by Freddie Mac.